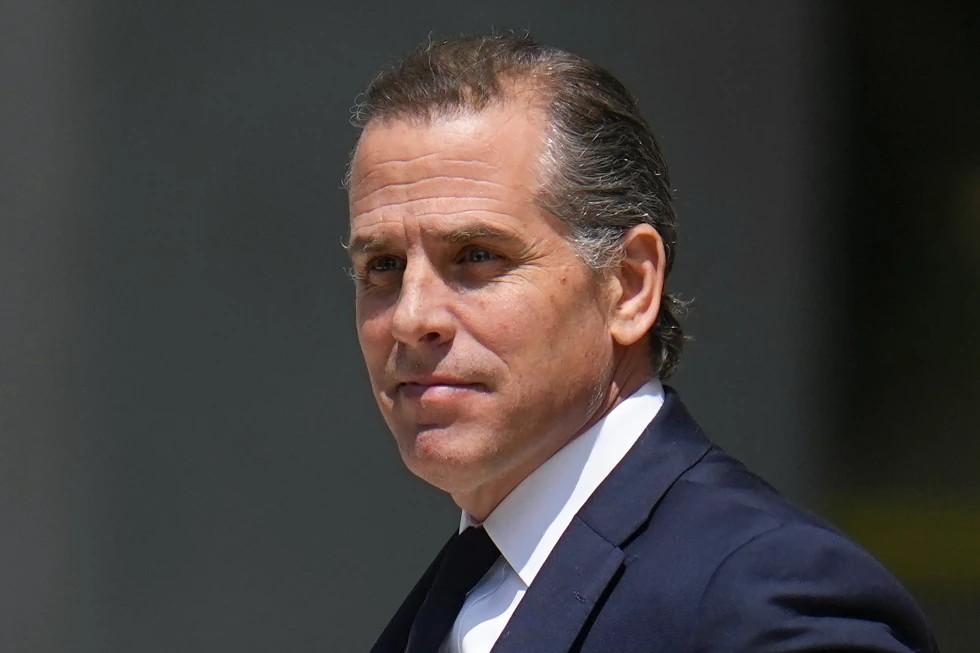

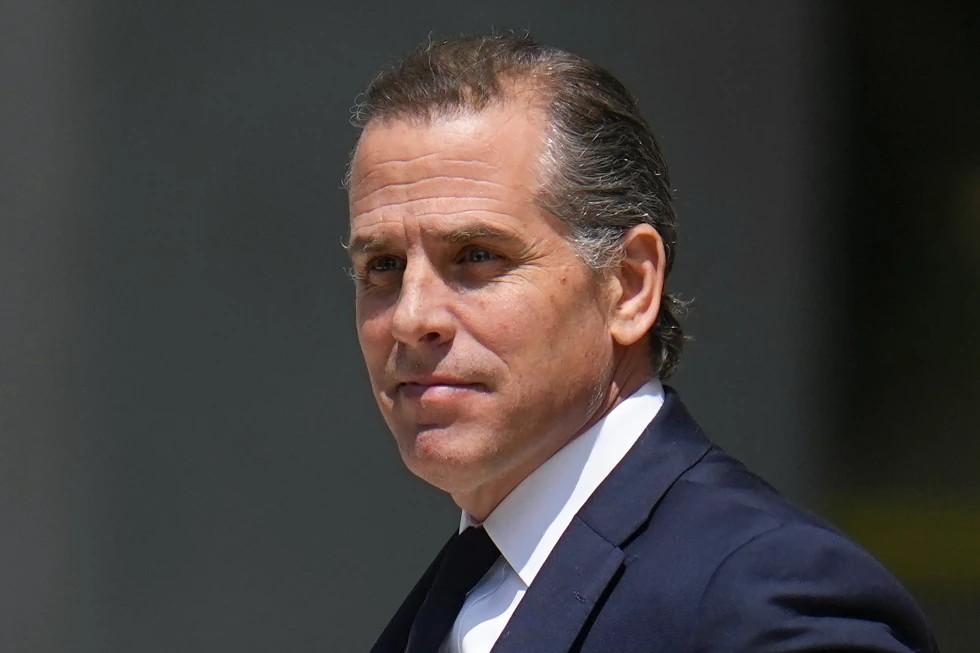

Hunter Biden was indicted on nine tax charges in California on Thursday as a special counsel investigation into the business dealings of the president’s son intensifies against the backdrop of the looming 2024 election.

The new charges — three felonies and six misdemeanors — come in addition to federal firearms charges in Delaware alleging Hunter Biden broke a law against drug users having guns in 2018.

Hunter Biden “spent millions of dollars on an extravagant lifestyle rather than paying his tax bills,” special counsel David Weiss said in a statement. The charges are focused on at least $1.4 million in taxes he owed during between 2016 and 2019, a period where he has acknowledged struggling with addiction.

If convicted, Hunter Biden could face up to 17 years in prison. The special counsel probe remains open, Weiss said.

Hunter Biden had been previously expected to plead guilty to misdemeanor tax charges as part of a plea deal with prosecutors. Defense attorneys have signaled they plan to fight any new charges, though they did not immediately return messages seeking comment Thursday.

The White House also declined to comment on Thursday’s indictment, referring questions to the Justice Department or Hunter Biden’s personal representatives.

The agreement, which covered tax years 2017 and 2018, imploded in July after a judge raised questions about it. It had also been pilloried as a “sweetheart deal” by Republicans investigating nearly every aspect of Hunter Biden’s business dealings as well as the Justice Department’s handling of the case.

Congressional Republicans have also pursued an impeachment inquiry into President Joe Biden, claiming he was engaged in an influence-peddling scheme with his son. The House is expected to vote next week on formally authorizing the inquiry.

While questions have arisen about the ethics surrounding the Biden family’s international business, no evidence has emerged so far to prove that Joe Biden, in his current or previous office, abused his role or accepted bribes.

The criminal investigation led by Delaware U.S. Attorney David Weiss has been open since 2018, and was expected to wind down with the plea deal that Hunter Biden had planned to strike with prosecutors over the summer. He would have pleaded guilty to two misdemeanor tax evasion charges and would have entered a separate agreement on the gun charge. He would have served two years of probation rather than get jail time.

The agreement also contained immunity provisions, and defense attorneys have argued that they remain in force since that part of the agreement was signed by a prosecutor before the deal was scrapped.

Prosecutors disagree, pointing out the documents weren’t signed by a judge and are invalid.

After the deal fell apart, prosecutors filed three federal gun charges alleging that Hunter Biden had lied about his drug use to buy a gun that he kept for 11 days in 2018. Federal law bans gun possession by “habitual drug users,” though the measure is seldom seen as a stand-alone charge and has been called into question by a federal appeals court.

Hunter Biden’s longstanding struggle with substance abuse had worsened during that period after the death of his brother Beau Biden in 2015, prosecutors wrote in a draft plea agreement filed in court in Delaware.

He still made “substantial income” in 2017 and 2018, including $2.6 million in business and consulting fees from a company he formed with the CEOs of a Chinese business conglomerate and the Ukrainian energy company Burisma, but did not pay his taxes on a total of about $4 million in personal income during that period, prosecutors said in the scuttled Delaware plea agreement.

He did eventually file his taxes in 2020 and the back taxes were paid by a “third party” the following year, prosecutors said.