For centuries, we Nepalis have dreamed of owning real estate before we retire. We may link real estate with prestige and a safe investment vehicle, which is why we want to possess it. We also wish to use real estate to produce passive income to help with our monthly or recurrent bills and relieve financial stress after retirement. However, a lack of liquidity, lesser cash flow (from rentals), expensive repair costs, and having to deal with tenants (both good and bad) can all be major roadblocks to landlords achieving their objectives. Real estate investment trusts (REITs) are financial structures used by countries such as the United States and India to hold real estate and avoid these issues. REITs, on the other hand, do not exist in Nepal, so Nepali investors are missing out on this potential.

First, let's understand REITs. They are companies that own or finance income-producing real estate across a range of property sectors and are mostly traded on the stock exchange. They typically own commercial properties such as towers, shopping malls, apartment buildings, hospitals, and care facilities, which create higher rental yields and an increase in value. They are required by law to pay the bulk of their taxable profit to their investors in the form of dividends (usually 90%). Dividends are given out on a monthly or quarterly basis. Let's look at some of the biggest concerns with real estate ownership and how REITs can help.

- High-cost barrier to entry: Over the last decade, real estate prices have skyrocketed. Within a decade, a property purchased for Rs 300,000 per aana on the outskirts of Butwal has increased in value to Rs 2 million. It is really difficult for an average Nepali with an average job to acquire land in big cities, where prices start at Rs 1 million per aana. To be able to purchase them, you'll need to save for years. REITs are available for purchase at a fraction of the price of common or preferred shares on the stock exchange where they are traded. This will ensure that everyone will be able to invest in REITs.

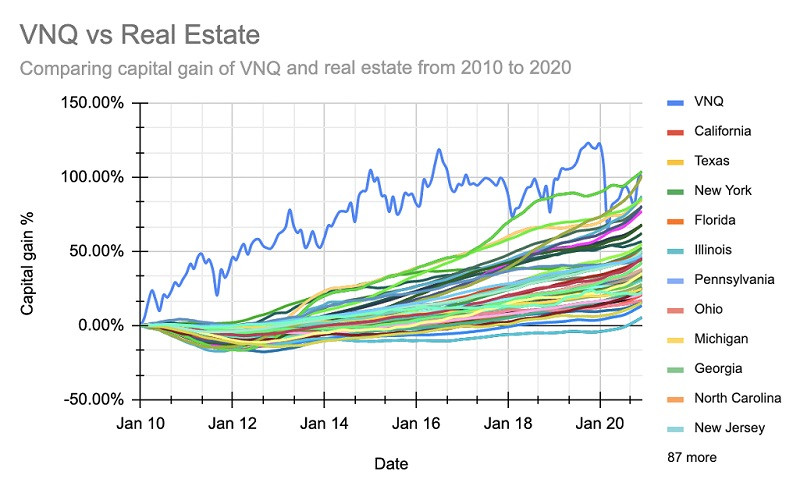

- Lower capital gain: Because we don't have REITs in Nepal, we can't make a direct comparison between their performance and that of real estate. Using data from the United States, which has seen a boom in real estate gains, we can show that REITs outperform real estate by a significant margin. As seen in the graph, Vanguard Real Estate ETFs (VNQ) returned 100.92 percent capital gain from 2010 to 2021, whereas the average real estate return was 44 percent throughout the same time period. Only four states have surpassed VNQ's performance throughout this time span.

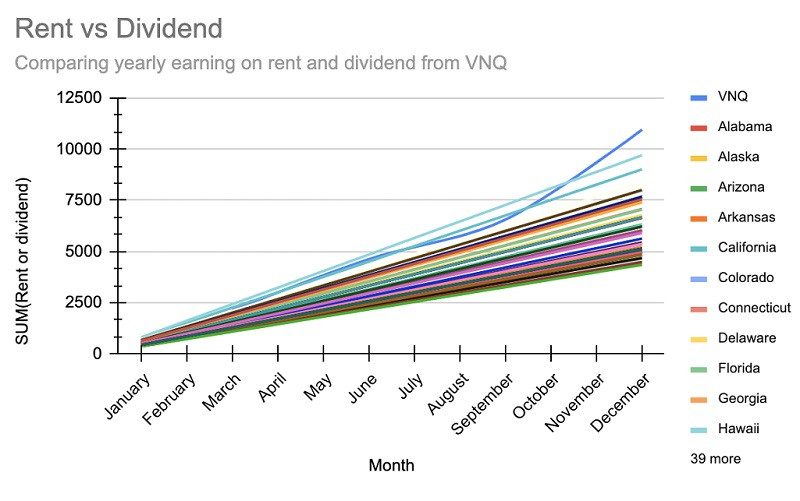

- Lower cash flow opportunity: One of the most lucrative aspects of owning real estate for retirees is the ability to generate cash flow or rents. As shown in the graph, REIT dividend yield beats total state rent collection by over 45 percent in the United States.

Even in Nepal, a Rs 40 million property in Kathmandu (identical to the one I'm renting for my office) brings in Rs 20,000 per month per floor. Two floors are rented out, while the third serves as a living area for the landlords. As a result, it earns Rs 40,000 thousand while saving you Rs 20,000 meaning Rs 60,000 per month, or Rs 720,000 per year. This is only a 1.8 percent gain. VNQ may create Rs 1.46 million per year and Rs 121,666.67 per month with the same amount of money at a 3.65% return - the amount of money needed to live comfortably in Nepal.

- Risk management: While real estate is a low-risk, high-yielding investment, REITs diversify it and make it even safer. REITs own a variety of income-producing properties in a variety of industries. Even if one property or industry fails, they will still be able to make money from the remaining ones. It will, however, be extremely difficult for the average real estate investor to replicate.

- Liquidity issue: Selling and buying property is a time-consuming process that takes 30-45 days from listing to closing, which can be troublesome if liquidity is required. REITs, on the other hand, can be sold with a single click and money deposited into your bank account within a week (at max).

In 2020, an investor who invested $135,000 in the United States in 2010 would have made $98,753.76 in dividends (73 percent return) and $135,000 in capital gain (100 percent return). At the same time period, a real estate investor would have made $26,668.39 in rents (19.75 percent return) and $59,710.5 in capital gain (44.23 percent), while being exposed to all the risks mentioned above. REITs investors (173 percent total return) would be 109.02 percent ($147,177) better off than investors in real estate (63.98 percent total return).

While there are dangers associated with REITs like fees, tax treatment, and investing in unsuitable or maturing REITs, they also provide an opportunity for investors to earn passive income while avoiding risks. In countries like the United States, many mutual funds and retirees have taken advantage of this to achieve early retirement or a safer retirement. REITs reduce or eliminate issues such as liquidity (in comparison to real estate, which takes time to trade), maintenance costs, and dealing with tenants, as well as lowering risk and providing increased cash flow, capital gain, and a lower barrier to entry. For investors, introducing REITs to Nepal would be a fantastic opportunity.